capital gains tax proposal

Treasury Secretary Janet Yellen. Ad Track Clients Potential Tax Liability with Tax Evaluator.

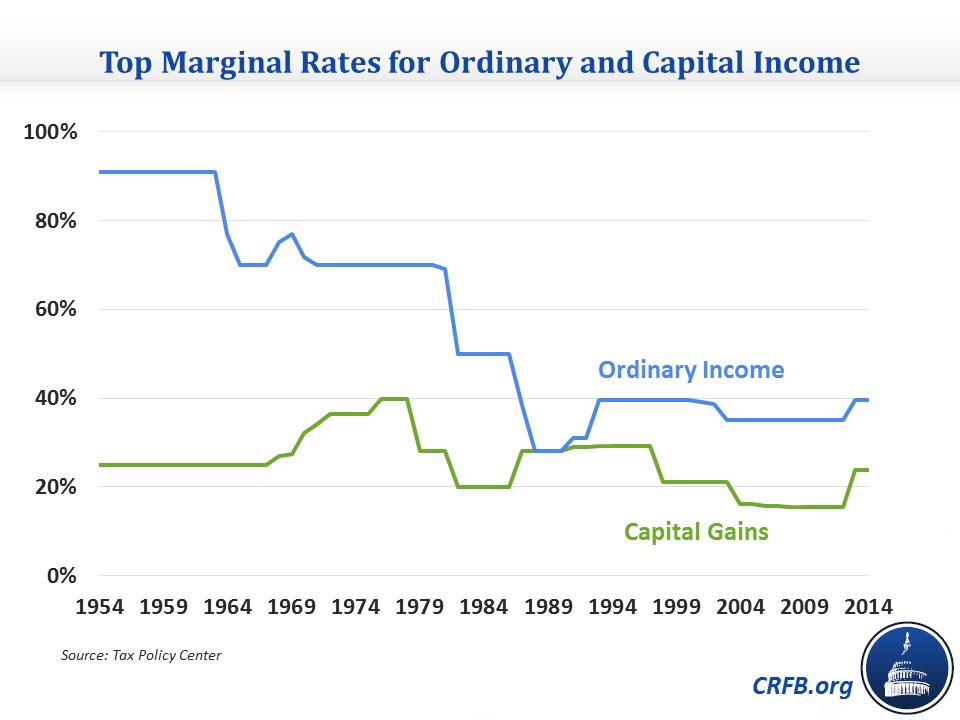

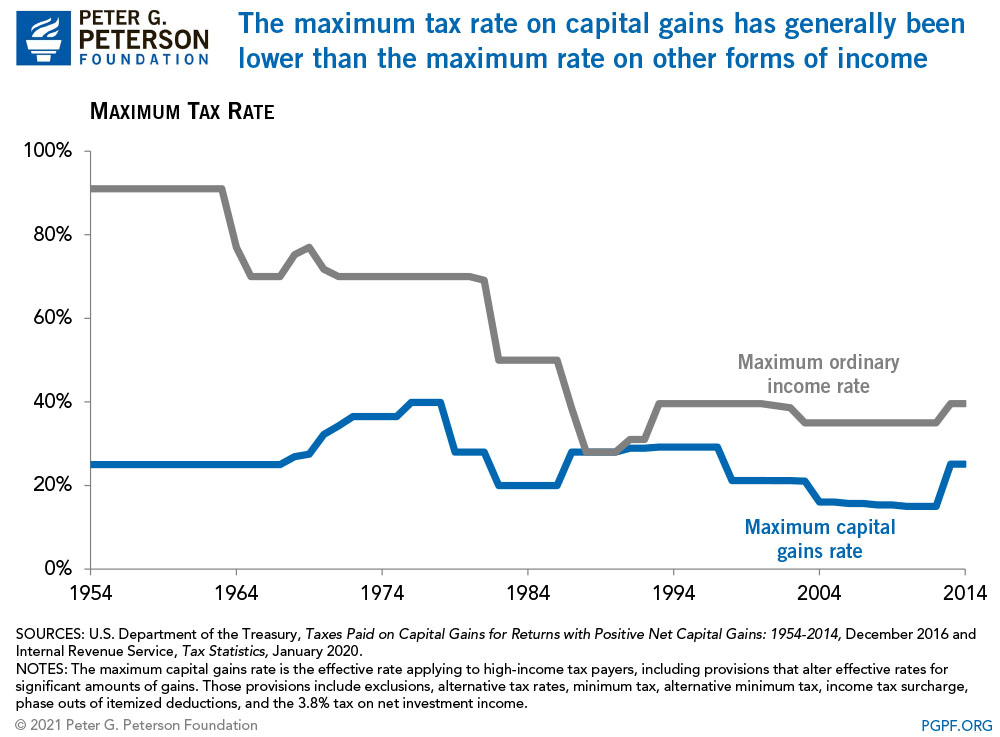

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

The top marginal income tax bracket.

. Subscribe to receive email or SMStext notifications about the Capital Gains tax. Tax policy was a part of the 2016 presidential campaign as candidates proposed changes to the tax code that affect the capital gains tax. It would apply to those with more than 1 million in annual income.

Since 2018 only estates valued at 117 million for. Raising the top capital gains rate for households with more than 1 million. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax.

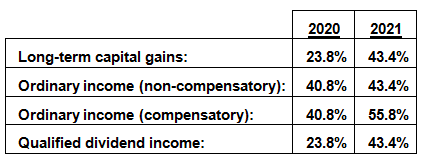

Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. House Democrats proposed a top 25 federal tax rate on capital gains and dividends. The changes that would affect trusts and estates relate to the federal estate tax and capital gains tax.

The Build Back Better proposal would apply a new surcharge of 8 percentage points to modified adjusted gross income MAGI above 25 million including on capital gains. Senior Democrats confirmed that a proposal to tax billionaires unrealized capital gains will likely be included in President Bidens 2 trillion spending package. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons.

The tax hike would apply to households making more than 1. Capital gains tax proposal QA Office of Financial. Read this guide to learn ways to avoid running out of money in retirement.

In most cases you dont have to pay capital gains tax on the sale of. This rate hike will affect stocks bonds. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396.

It would apply to single taxpayers with over 400000 of income and married. Ad Learn ways dividends can help generate income in this free retirement investment guide. It hasnt been noticed much but proposed changes to capital-gains taxes have good news for some of the highest-earning Americans and bad news for those earning.

The American Families Plan Fact Sheet Biden Administration General Explanation of the Administrations Fiscal Year 2022 Revenue Proposals US Dept of the Treasury BTAX OnPoint. Capital gains tax is a tax on the profit you make from selling something at a higher price than you paid for it. 2 weeks ago Mar 15 2021 Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the.

President Donald Trump s main proposed change to. The individual tax rate could just from 37 to 396 for those making more than 400000 annually. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers.

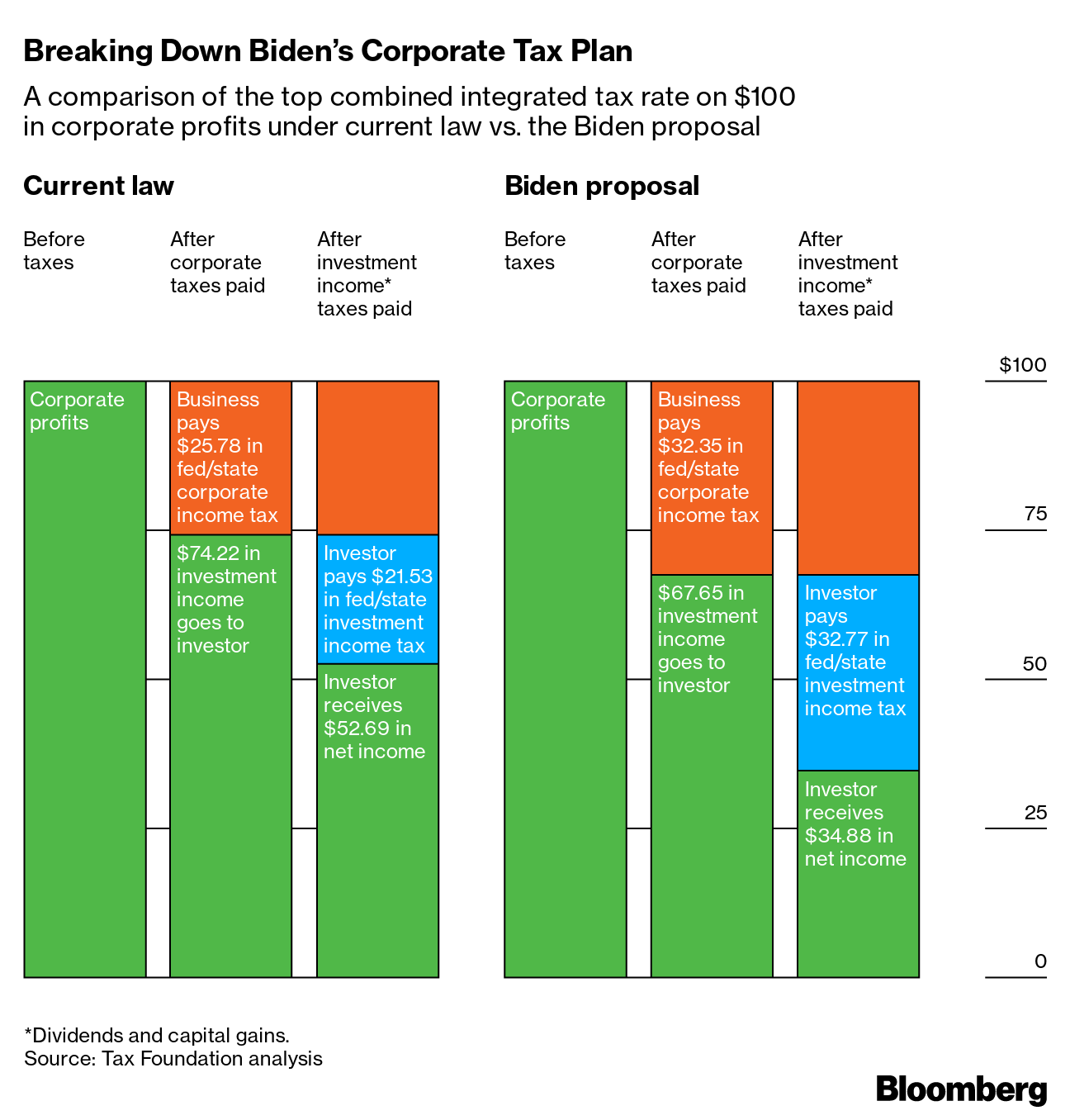

Given what the president has proposed the wealthiest people in the US could see a significant hike in the capital gains tax rate. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. The Presidents tax plan would raise the top ordinary tax rate from 37 to 396.

Part of a larger bill uncontroversially titled the American Families Plan Biden would raise taxes on the well off in a few different ways. Janet Yellens recent proposal to tax. The Problems With an Unrealized Capital Gains Tax.

For taxpayers with income over 1 million Biden has proposed raising the top capital gains rate to 396 as.

Read This On The New Capital Gains Tax Proposal On Page 61 In Other Words They Want To Tax Anybody That Gain Over 1 000 000 37 In Which It Will Help Prevent Economy

Capital Gain Tax Change In 2021 Blind

Capital Gains And Capital Pains In The House Tax Proposal Wsj

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Will The Unrealized Capital Gains Tax Proposal Apply To Most Investors The Motley Fool

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

House Democrats Propose Hiking Capital Gains Tax To 28 8

American Families Plan Potential Investor Impacts Russell Investments

Biden S Capital Gains Tax Proposal Will Likely Be Watered Down Says Strategas Trennert

Biden Capital Gains Tax Proposal And The Roth Ira Ira Financial Group

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Biden S Capital Gains Tax Proposal Puts Estate Planners To Work Wsj

Biden S Capital Gains Tax Proposal And The Qsbs Tax Exclusion Qsbs Expert

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan

The U S Can T Afford A Tax Policy That Punishes Wealth Bloomberg

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Capital Gains Tax Proposal Passes Washington House Heads Back To Senate King5 Com